Daily Digest

Read our daily digest packed with a wealth of financial tips and tricks to help you navigate the world of money management. Whether you’re looking to improve your personal finances or enhance your business’s financial health, these digest will provide valuable insights and advice for you and your business.

Why should I read?

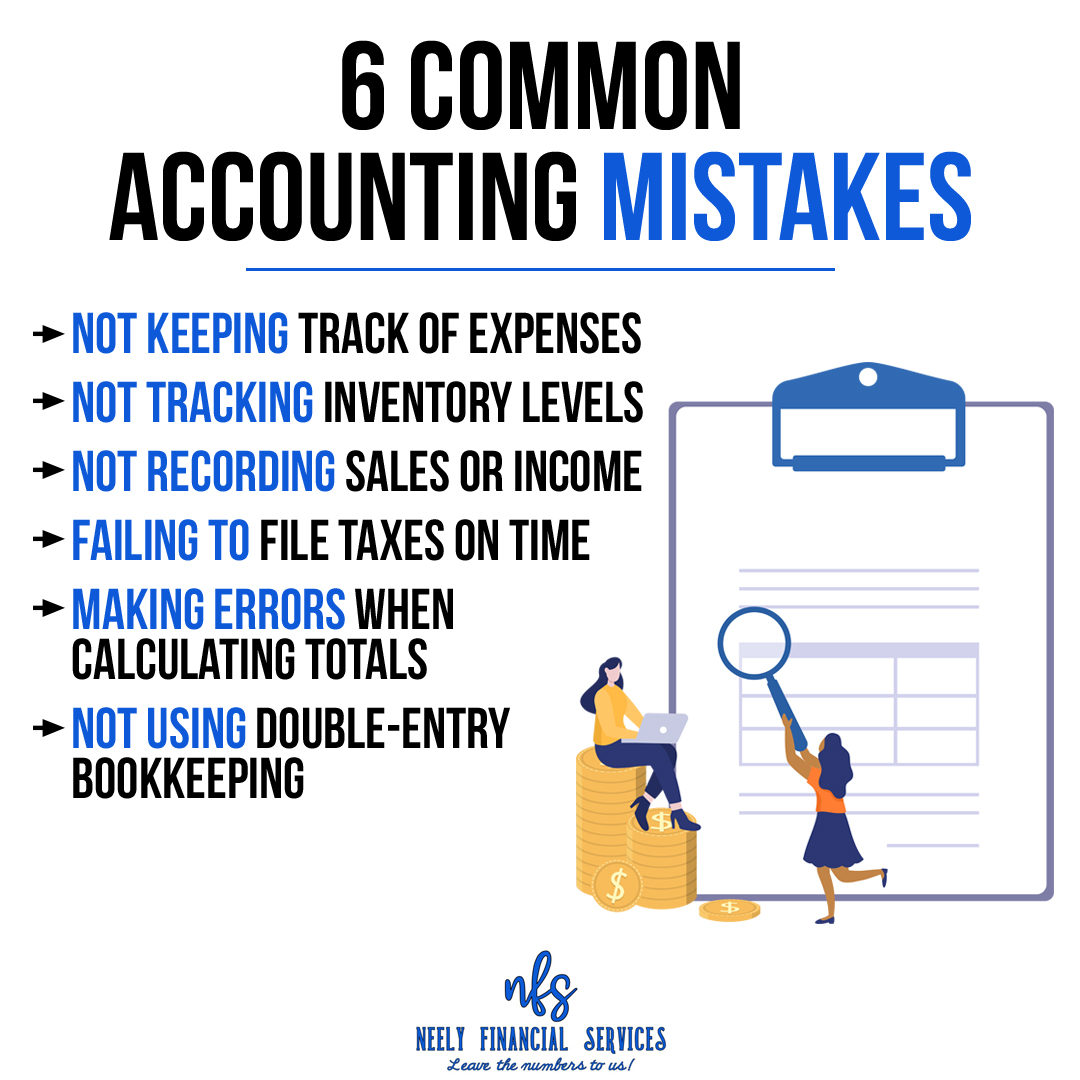

1. Informed Decision Making: Financial data provides valuable insights that help businesses make informed decisions. Whether it’s about investment opportunities, expansion plans, or cost-cutting measures, having access to financial information allows businesses to assess risks and rewards accurately.

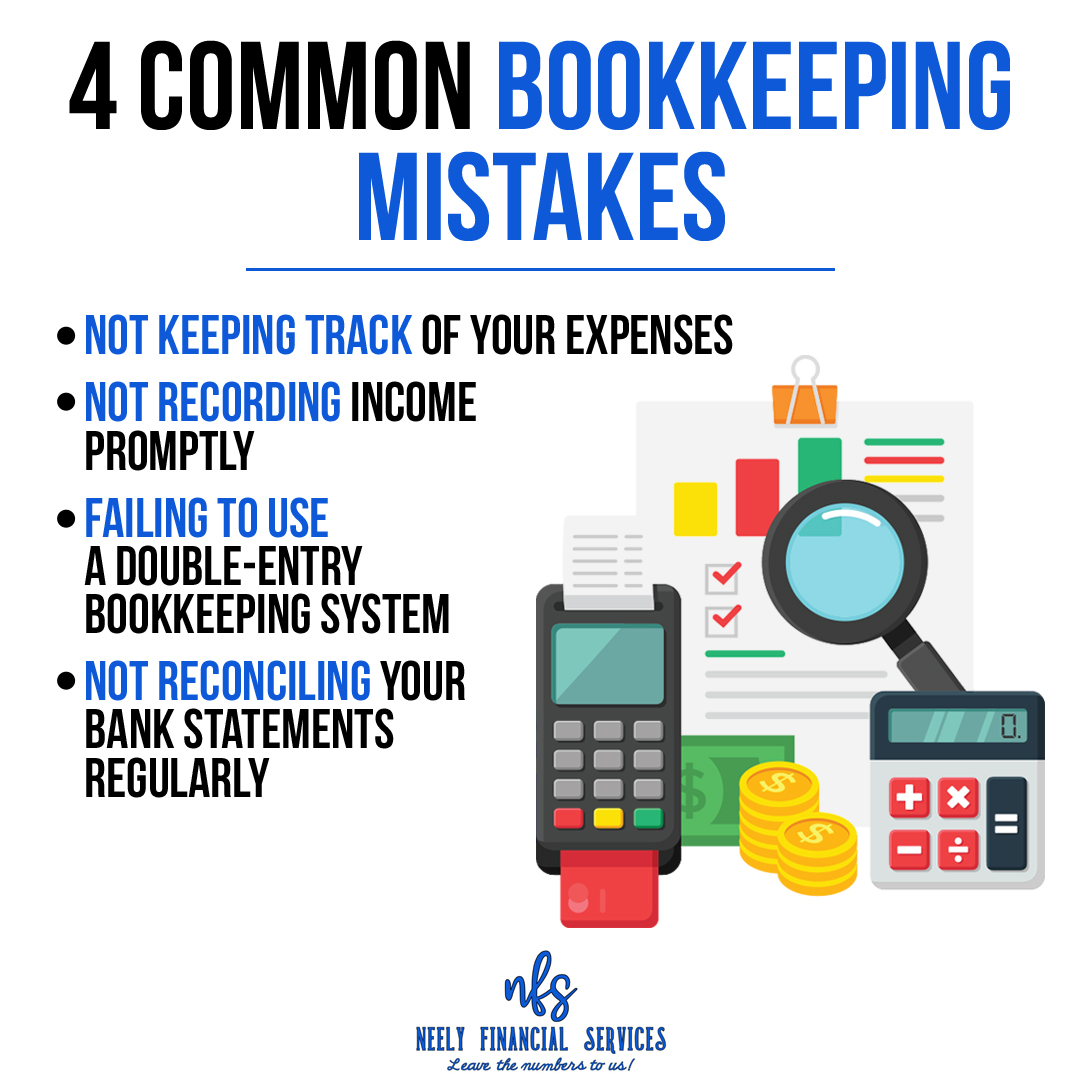

2. Performance Evaluation: Regularly monitoring financial performance helps businesses evaluate their progress towards goals and objectives. By analyzing key financial metrics such as revenue, expenses, profitability, and cash flow, businesses can identify areas of strength and weakness and take corrective actions as needed.

3. Risk Management: Understanding financial data enables businesses to identify potential risks and vulnerabilities early on. Whether it’s market fluctuations, supply chain disruptions, or regulatory changes, businesses can proactively implement risk mitigation strategies to safeguard their financial health.

4. Strategic Planning: Financial information plays a crucial role in strategic planning and resource allocation. By analyzing financial trends and projections, businesses can develop long-term strategies that align with their financial capabilities and objectives, ensuring sustainable growth and profitability.

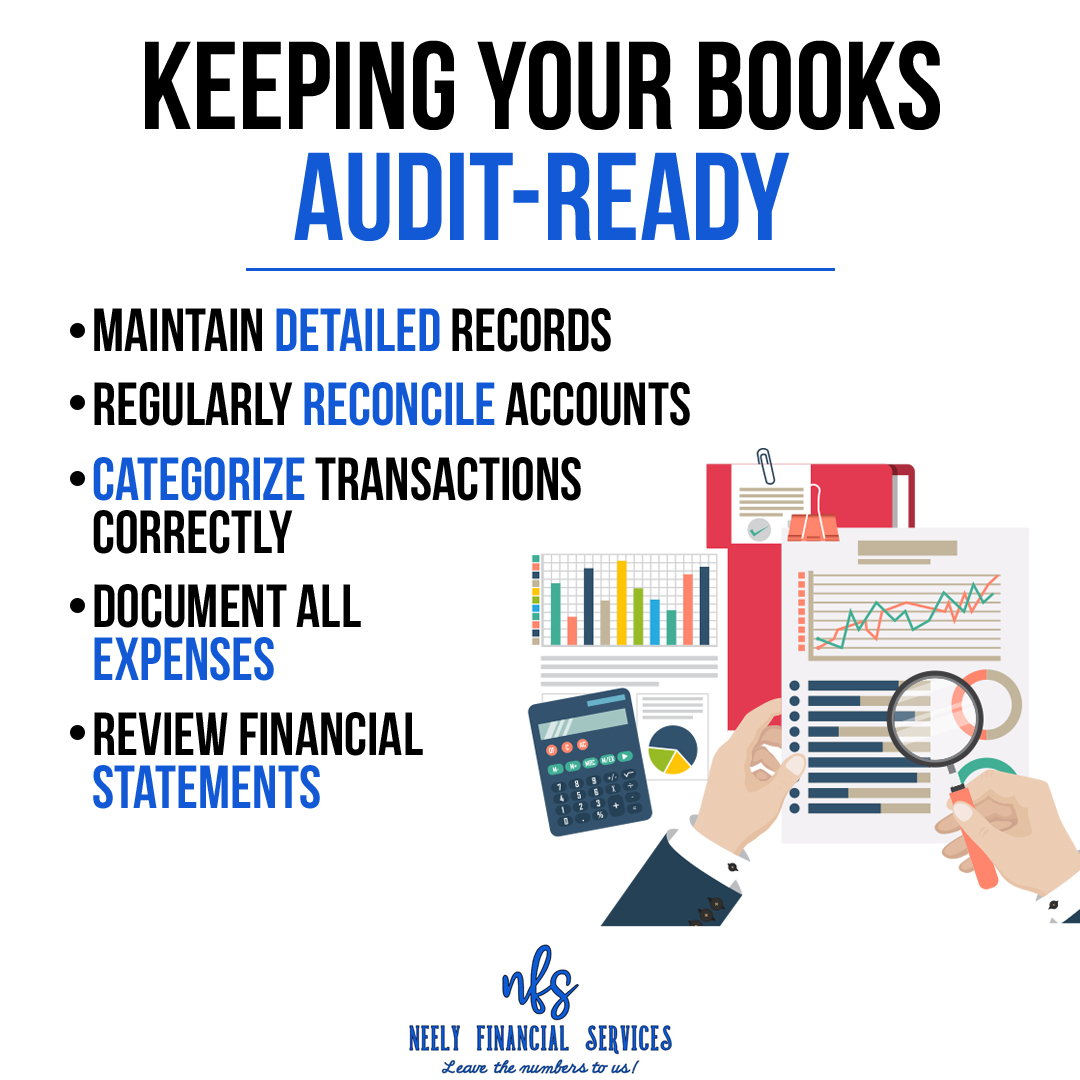

5. Compliance and Accountability: Businesses are subject to various financial regulations and reporting requirements. Keeping abreast of financial information ensures compliance with regulatory standards and enhances accountability to stakeholders. Failure to maintain accurate financial records can lead to legal and financial consequences for businesses.

6.Tax Planning: Financial data is essential for tax planning and compliance. Businesses use financial information to calculate tax liabilities, identify eligible deductions and credits, and ensure timely and accurate filing of tax returns to avoid penalties and audits.

7. Cost Control: Access to financial information allows businesses to identify opportunities for cost control and efficiency improvements. By analyzing expenses and identifying areas of waste or inefficiency, businesses can optimize spending and improve profitability.

8. Financial Forecasting: Accurate financial forecasting relies on reliable data and analysis. Businesses use financial information to forecast future revenues, expenses, and cash flows, enabling proactive planning and decision-making to capitalize on opportunities and mitigate risks.